High Performance Bonus Fee

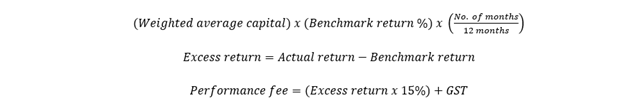

Our actively managed investment service includes a performance fee payable to the asset consultants. The performance fee is calculated and paid quarterly in arrears directly from your investment portfolio cash account. The performance fee is 15% of the fund’s outperformance of the agreed benchmark plus GST. Set out below is a description of the workings of the performance fee formula.

“Benchmark” means the agreed benchmark that is based on client return and risk expectations. It is always calculated in terms of 'per annum after all fees'. For example a balanced growth investment portfolio has a benchmark return of 8% per annum after all fees.

The underlying assumptions when creating the high performance bonus model is that your “Benchmark Return” will be achieved reliably over time and that there will be more years of outperformance than under performance.

“Performance Period” means the period from the Starting Date to the cut-off date for which the performance fee is being calculated.

We align our computation of bonus with the financial yearend in Australia. We determine the valuation of your portfolio every 30th of June and we carry it over to next financial year as the opening fund value starting 1st of July. We therefore restart the bonus computation every 1st of July which will span for 1 year to 30th of June next year.

“Starting Date” for a performance period means:

The first day of the financial year or the date of your initial investment, whichever is later.

If you invest your money with us in the middle of the financial year, the starting period shall be the date of initial investment. Consequently, the bonus computation will be prorated based on the remaining time from initial investment to the cut-off date.

“Yearend Date” for a performance period means:

The 30th of June for a particular year.

“Cut-off Date” for a performance period means:

The end of the quarter of a specific performance period. We determine the cut-off date because you agree that the performance fee shall be determined and be paid on a quarterly basis. However, if the cut-off date is for the month of June, then the cut-off date is also the yearend date.

“Benchmark” means the agreed benchmark per annum after management fees, but before deducting the performance fee, confirmed by yourself and your financial planner.

“External Cash Flows” means any capital infusion, rollover, deposit, made by you to the fund. External cash flow applies also to any withdrawals and payments made by you from the fund.

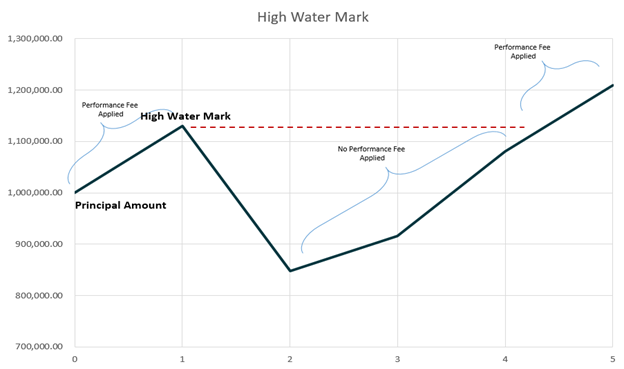

“High Water Mark” means the highest net of management fee closing fund value achieved by the Asset Consultant in which a performance fee is charged. Assuming your fund declines in value in subsequent period, the fund should first recover the losses incurred before a performance fee is paid. Hence, the fund shall exceed the High Water Mark before we charge you again a performance fee. This protects you from paying twice for the same performance of your fund.

The illustration above assumes that the fund outperformed the benchmark rate.

“Opening Fund Value” means the dollar market value of the fund to be set at the beginning of the Performance Period for purposes of calculating the excess return and performance fee.

As stated in the performance period, we apply our model calculation for each financial year ranging from 1st of July to 30th of June next year. Assuming your portfolio has outperformed the benchmark rate, the closing fund value at yearend shall be carried over as the opening fund value for the subsequent financial year.

For example, if you invest $1,000,000 at 1 July 2020, with an agreed benchmark of 10% but at the end of financial year, on 30 June 2021, the value of your portfolio exceeded the benchmark and returned 18%, it is valued at $1,180,000 rather than the benchmark closing value of $1,100,000 (+$1,000,000 x 10%). In the next financial year 2022, we will carry over the fund value of $1,180,000, instead of the benchmark fund value of $1,100,000, as the opening fund value. The higher opening fund value promotes your best interest since a higher opening fund value requires a higher benchmark target return each year that benchmark is achieved or exceeded. In years where benchmark is not exceeded, there is no high performance bonus attributable.

If there are periods of decline and uncertainty in your fund, then for purposes of computing the performance fee, we will use as the Opening Fund Value the highest among the (1) Preceding Closing Fund Value, (2) High Water Mark, or (3) principal investment amount.

“Closing Fund Value” means the dollar market value of the fund as of the cut-off date.

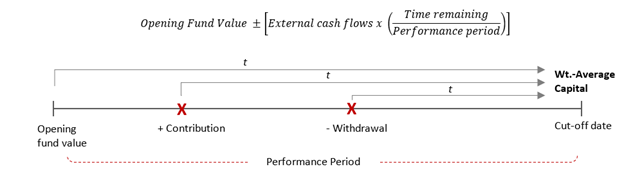

“Weighted-Average Capital” means your average capital for a specific period of time, weighted by the time from cash flow date to the cut-off date. This capital reflects the true amount of capital utilized by the Asset Consultant in generating the returns for a specific period of time.

For example, your opening fund value is $1M. However, 3 days after the beginning date, you withdraw $400k from your investment. Therefore, for the next 87 days of the performance period, the asset consultant effectively utilizes a capital amount of $600k in generating the returns. This arises the need to determine the weighted-average capital, as the benchmark capital to reflect the true capital utilized by the Asset Consultant. Every cut-off date, the prorated benchmark rate shall be applied against the weighted-average capital which is the:

Outline of the Performance Fee Formula

Performance will be calculated every end of the quarter with a reset at every 30th of June. The performance fee will be calculated on the Opening Fund Value. If the Asset Consultant is entitled to a performance fee it will be paid quarterly directly from the cash account of the portfolio. If there are insufficient funds available in the cash account to pay the performance fee, holdings will be sold from securities that are nearest to “Fair Value”. If the securities held include Exchange Traded Funds (ETF’s) or Managed Funds, the Investment Committee will analyse financial market, economic and ETF research to determine which investments are considered the most appropriate to sell based on forecast global, regional, sectoral and industry performance expectations.

“Fair Value” as defined by our global investment research provider Morningstar is a “detailed projection of a company’s future cash flows, resulting from our analysts’ independent primary research. Analysts create custom industry and company assumptions to feed income statement, balance sheet, and capital investments assumptions into a globally standardised, proprietary discounted cash flow, or DCF, modelling template. This modelling tool uses scenario analysis, in depth competitive advantage analysis, and a variety of other analytical tools to augment the process and subsequently define the fair value of a security.”

We apply a ‘total portfolio’ perspective in assessing your investments, thus, consolidating all the investment accounts we manage for you before we assess the performance. This allows us to clearly communicate to you how your portfolios are performing in aggregate relative to the agreed investment objective. The total portfolio perspective is applicable if you have more than 1 account being managed by our asset consultant team. This promotes your best interest as this mechanism avoids a scenario where, for example, 1 of your account is outperforming well while the 2nd account is underperforming and we are charging the 1st account while no charge for the 2nd account. To promote your best interest, we will view and consolidate all of your accounts and calculate if the total portfolio still outperforms the calculated benchmark.

A performance fee will be accrued and paid in any Performance Period if the accumulated performance (after all fees but before the performance fee) of the Portfolio from the Starting Date until the end of the current Performance Period exceeds the accumulated performance of the Benchmark over the same time, prorated by the lapsed time from the starting date to quarter-end.

For example, if the Portfolio outperforms the Benchmark in quarter 1, then a performance fee is accrued and paid at the end of quarter 1. For quarter 2, the performance of the fund from quarter 1 and quarter 2 is accumulated. Then a performance fee will be calculated based on the cumulative return for quarter 1 and quarter 2. Upon determining the accumulated performance fee for the 2 quarters, the performance fee/s in previous quarter shall be deducted to isolate the applicable performance fee for the quarter 2 only.

For quarter 3, same principle applies. The performance of the fund for the 3 quarters shall be accumulated. The excess returns for the 3 quarters and the performance fee are calculated. Upon determining the performance fee for the 3 quarters, the previous performance fees shall be deducted to arrive only at the current quarter performance fee.

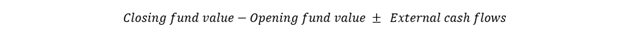

If the test set out above is met, then the dollar out performance payment for that period is calculated by multiplying 15% (the performance fee %) by the excess return. Excess return is determined by calculating first the fund’s actual return and the benchmark return. Actual return is computed as

Any deposits in the fund are deducted and any withdrawals are added back to the fund to determine the actual return generated by Asset Consultant. This is to ensure that the increase in fund value is due to return generated and not due to capital infusion of the investor.

Benchmark return is computed as:

For example, in the first quarter, the actual return of the fund is $10,000 while the computed benchmark return is $8,000. The performance fee for the Asset Consultant is $300 ($2,000 x 15%) plus GST. In the 2nd quarter, the accumulated return is $19,000 while the benchmark return for the 2 quarters is $16,000 ($8,000 x 2). The excess return for the period is $3,000 while the performance fee is $450 ($3,000 x 15%). However, the excess return and performance fee encompasses quarters 1 and 2 and therefore, the $300 fee in quarter 1 needs to be deducted from $450 which will result to a performance fee attributable only to quarter 2 in the amount of $150 plus GST. This methodology will continue up to the end of the financial year, then we will restart the process for the next financial year, beginning again in quarter 1.

Ongoing Product Costs

Each investment product provider charges what is called an Indirect Cost Ratio (ICR). This covers the cost of operating ETF’s and managed funds, and as such different managers have different charges so it varies from fund to fund. This is received by the provider directly, and is not paid to your adviser. An estimate of the ICRs charged on your recommended investments. Where ICR’s are applicable they are included in the investment research provided within a Statement of Advice.