Investment

A simple definition of “invest” is to apply or use money with the intention of obtaining income or profit. Too often investing is confused with speculation. Speculation refers to buying and selling stocks and other assets to take advantage of short term fluctuations in prices to make profits. Speculation is subject to a high degree of uncertainty and risk, that is, taking a gamble to buy low and sell high (but how high is high enough and what if the price drops instead of rising?).

To understand investments and to subsequently make investment decisions that meet your needs, it is important to understand the following key concepts:

- Asset classes – understanding the investment return and risk profile of each asset class will help you match your investments with your investment time horizon.

- Income versus growth investments – understanding the type of return each asset class is likely to deliver will help you match your investments with your investment income goals.

A few other investment concepts worthy of consideration when determining your investment strategy are:

- the potential for volatility in returns – the case for diversification (not placing all of your eggs in the one basket), and

- investing internationally.

Asset classes

The main asset classes that may be invested into directly or via managed funds are generally cash, Australian fixed interest, international fixed interest, Australian shares, international shares, listed property (ie. listed on the stock exchange) and direct property.

The risk and performance of investments can be determined by measuring the returns against a benchmark. Some commonly used benchmarks are shown in the following table.

|

Asset class |

Benchmark |

|

Cash |

UBS Australian Bank Bill Index |

|

Australian fixed interest |

UBS Australian Composite Bond Index(All mat) |

|

International fixed interest |

Salomon Smith Barney World Government Bond Index(ex Australia) Barclays Global Aggregate Bond Index |

|

Listed property |

S&P/ASX 300 A-Reit Index |

|

Direct property |

Morningstar PG Unlisted and Direct Property Index |

|

Australian shares |

S&P/ASX 200 Accumulation Index |

|

International shares |

MSCI World Index |

Investment timeframe

One of the primary issues to consider is the timeframe of investing, that is, the length of time to hold various classes of assets to obtain the benefit of investing. Investment timeframes are generally described as short term (1-3 years), medium term (3-5 years), and long term (5-7 + years).

Generally, it is recommended to hold cash and fixed interest type investments over the short term, property over the medium term and shares over the long term, due to the varying degrees of volatility (variability in returns) associated with these investments.

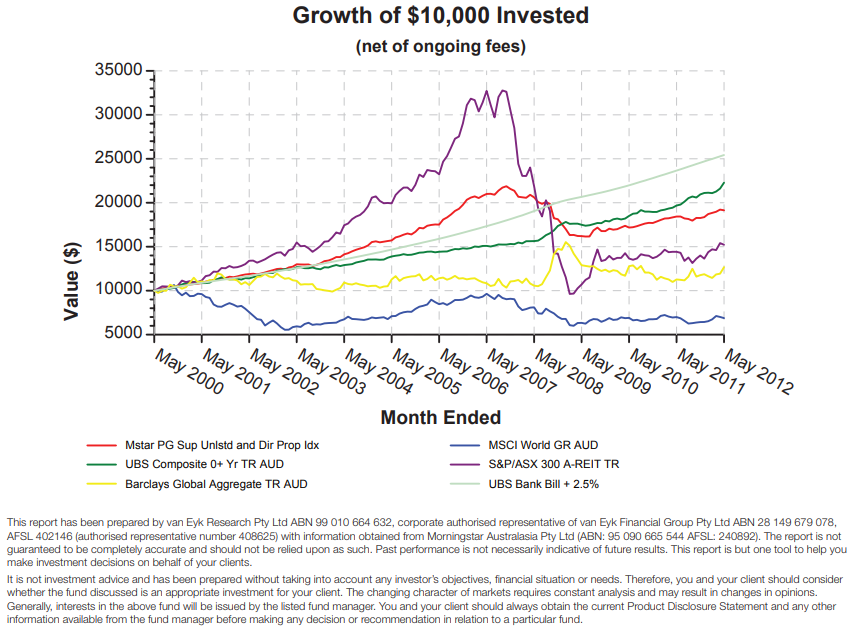

The benefits of holding long term type investments (such as shares) compared to short-term type investments (such as term deposits) are best shown in the following graph:

Generally, interests in the above fund will be issued by the listed fund manager. You and your client should always obtain the current Product Disclosure Statement and any other information available from the fund manager before making any decision or recommendation in relation to a particular fund.

Income versus growth investments

Generally, investments are purchased for their income-producing potential or because the capital value is expected to grow overtime, or for a combination of both reasons. Income can be in the form of interest from cash and fixed interest assets, dividends from shares or rental income from property. Capital growth can come from shares and property growing in value.

When comparing income investments with those producing capital growth it is important to compare the total after-tax return from each.

Income producing investments

Income producing Investments generally offer the advantage of high security of original capital. These investments include bank deposits, mortgages, and debentures with major finance companies. Property and shares also will provide income as a result of rents received and dividends, however these investments are not typically categorised as income-producing due to the inherent potential for capital volatility in the underlying investment.

The disadvantage of pure interest-bearing investments is that the return is generally fully taxable.

For example, if you were to earn 6% per annum and your marginal tax rate was 38.5 % (including Medicare levy of 1.5 %), your after-tax return would be only 3.69% per annum. The effective (or real) rate of return depends on the rate of inflation and your marginal rate of taxation.

Your after-tax return therefore needs to be more than the rate that prices increase by each year, otherwise the purchasing power of your money will be reduced.

Income-producing investments provide good security of original capital but no additional growth potential to maintain the ability of investment returns to keep pace with inflation.

Capital growth Investments

Capital growth investments include property investments, Australian share investments, and international share investments.

These investments rely on an increase in the capital value of the asset purchased, whether the investment is directly held in real property, shares or similar, or indirectly by investment through a managed fund. Many capital growth investments also provide an income. For example, Australian and International shares provide dividends, while property investments provide rental income.

The balance of growth and income varies so it is important that you seek advice when deciding which options best suit your needs.

There are two major considerations for capital growth investments:

Firstly, by diversifying into asset classes (such as shares and property) it is possible to take advantage of favourable investment conditions which generally provide superior growth over the long term (5-7+ years).

Secondly, for individuals, capital growth on the sale of all or a portion of an asset, if the asset has been held for more than 12 months, is subject to capital gains tax (CGT) as follows:

- For assets purchased before 20 September 1985, the gain is exempt from CGT.

- For assets purchased on or after 20 September 1985 and before 21 September 1999, the investor has a choice between using the indexed cost base method or the discount method (50% for individuals) for calculating the gain.

- For assets purchased on or after 21 September 1999, 50% of the gain is subject to CGT.

An important factor relating to CGT is that it is not payable until the investment is sold, thus any tax liability may be deferred into the future at which time lower personal tax rates may apply depending on your situation.

Risk/return trade-off

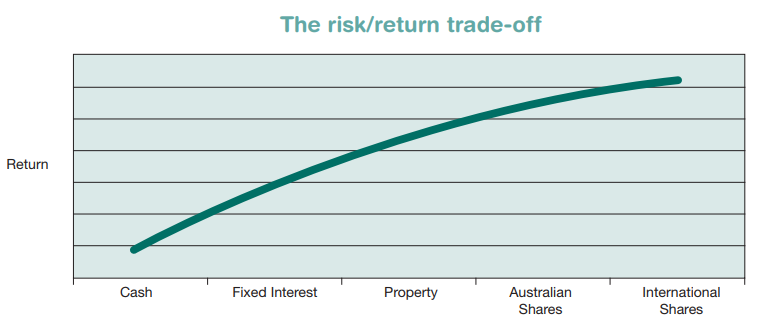

As investors, in general, are risk averse, they will require a higher rate of return before accepting a higher degree of risk; this is referred to as the ‘risk premium’. Accordingly, as potential risk increases, so too does expected return. This relationship is known as the risk/return trade-off. The risk/return relationship, over the long term, as it relates to the major investment markets, is represented in the following graph:

Understanding Share Dividends and Dividend Imputation

The table below shows the level of variability in returns (volatility) that was recorded by the main asset classes over the past ten years. The results that would have been achieved by a “balanced” portfolio are also shown for comparative purposes.

The balanced portfolio used in this example adopts the following asset allocation:

|

Calendar year returns |

|||||

|

Asset class |

Highest |

Lowest |

Average Years |

Number Of negative |

|

|

Cash |

5.65% |

0.42% |

3.83% |

Nil |

|

|

Australian Fixed Interest |

7.97% |

1.28% |

4.75% |

Nil |

|

|

Listed Property |

16.05% |

-18.53% |

0.25% |

6 |

|

|

Australian Shares |

15.71% |

-2.90% |

5.23% |

2 |

|

|

International Shares |

5.71% |

-7.46% |

0.45% |

6 |

|

|

Balanced |

10.24% |

-2.51% |

3.50% |

2 |

|

Source: van Eyk Research Indices used are Australian 90 Bank Bill Index (cash), Australian Commonwealth All Series All Maturities Index (Australian Fixed Interest), S&P/ASX300 Property Trusts Accumulation Index (property), S&P/ASX200 Accumulation Index (Australian Equities) and MSCI World ex Australia (AUD) Accumulation Index (international shares). Balanced portfolio is comprised 5% cash, 25% fixed interest, 10% property, 35% Australian shares, 25% international shares. Past performance is not a reliable guide to future performance.

It can be seen from this table that diversification has the effect of smoothing returns. That is, while a balanced portfolio offers some of the growth benefits of sectors such as property and shares, its cash and fixed interest components ensures that it does not have the same degree of volatility.

Understanding Share Dividends and Dividend Imputation

Dividends from Australian companies are distributed to investors after companies have paid tax on their profits. Under the dividend imputation system (which helps to avoid double taxation of company profits), investors receive a tax credit for the amount of tax that the company has already paid on the original profits. The system works as follows:

If a company makes a profit of $1,000 which is fully taxable, it pays tax at the current company tax rate of 30% which equates to tax paid of $300, leaving $700 available for distribution. If there are 10 shareholders, each receives an after-tax dividend of $70, with a $30 franking credit. Since the profits associated with the dividends have been fully taxed, the after-tax dividends are said to be fully franked. However, there are situations when this is not the case, and dividends can have partial or no franking.

For the purposes of our illustrations, we have assumed that dividends are fully franked.

For after-tax dividends, the grossed up amount (that is the shareholder’s share of the pre-tax profit) must be included in the shareholder’s tax return as assessable income. In this example, the grossed-up dividend amount is $100 ($70 plus the $30 company tax paid with respect to that dividend). However, a franking credit of $30 also applies.

In this example, the effect of the credit is that if the shareholder’s marginal tax rate is equal to 30% no tax will be paid on the dividends. If the marginal tax rate is less than 30%, this may result in a tax credit which could be used to offset other tax payable, Medicare levy, or be

received as a tax refund.

|

Shareholder’s marginal tax rate |

45% |

32.5% |

19% |

|

Franked dividend paid |

$70 |

$70 |

$70 |

|

Plus imputation credit (representing company tax paid) |

$30 |

$30 |

$30 |

|

Assessable Income |

$100 |

$100 |

$100 |

|

Tax assessed |

$45 |

$32.50 |

$19 |

|

Less: Franking credit |

($30) |

($30) |

($30) |

|

Tax payable |

$15 |

$2.50 |

Nil |

|

Excess credit to be offset against other tax payable/receive As a refund |

Nil |

Nil |

$11 |

|

Net dividend received |

$55 |

$67.50 |

$81 |

(excluding Medicare levy and flood levy)

Dividend imputation thus provides tax-effective income, where the dividends come from investment in tax-paying companies, either directly or through a unit trust or master fund.

For example, a retiree on a marginal tax rate of 19% (excluding Medicare levy) can receive dividends with no tax liability and can also use franking credits to offset Medicare levy, tax payable on other income, eg. interest income, or receive as a refund.

An example:

A retired person receives $70 as a fully franked dividend with a credit of $30.Total tax payable is $19 (19% of $100) but franking credits reduce this tax to zero.

In addition, the retiree has an excess franking credit of $11 ($30-$19). Therefore, if $200 income from a fixed interest investment is also received, the $30 tax liability on this investment income is reduced to only $19 by using the $11 credit.

Inflation risk

Inflation risk is the risk that the real value ( i.e. the purchasing power) of your investment may not keep up with inflation. This risk will occur if your investment is likely to provide a net (after tax) return less than the prevailing inflation rate.

Re-investment risk

In a fixed interest investment, re-investment risk is when you may have to accept a lower rate of interest when re-investing for another fixed term because of changes in market interest rates.

Liquidity risk

Liquidity risk is the risk that you may not be able to readily cash in your investment when you need immediate access to your funds in which case you may have to:

-redeem your investment at less than face value and make a loss, or

-agree to have the current interest rate adjusted because the investment was not retained to maturity, or

-wait until your investment matures, which could mean you miss out on other opportunities that may arise in the meantime.

Market risk

Market risk is the risk that investment market movements will result in investment values falling. For example, if you buy shares in a gold mining company at a certain share price and the price of gold falls (for whatever reason), it is highly likely that the price of your shares in the gold company will also fall.

Investing in Insurance Bonds

Bonds are a form of managed fund operated by life insurance companies and friendly societies. An insurance or investment bond (referred to as a bond) is essentially a life insurance policy and provides a simple and flexible way to save for future goal. A bond may involve a once-only premium payment (or investment), alternatively investors may take advantage of the 125% rule (see below) and make regular “top- ups” once the initial premium has been paid.

By investing in a bond, investors pool monies and the funds are managed by investment professionals. In this sense they operate similarly to Managed funds the main difference being the tax treatment of investment earnings. Bonds also offer the ability to switch between different investment options.

Depending upon the product, monies may be invested in a range of investment options such as cash, fixed interest property, Australian shares and international shares. This provides the opportunity for diversification within a single investment structure.

The investment returns on a bond are taxed in the hands of the insurance company and the earnings are reported net of this tax.

The tax on investment earnings is 30%. This can be reduced by dividend imputations credits and other offsets where the underlying investment has an exposure to Australian shares and property.

As the life insurance company pays the tax on investment earnings, there is no need for an investor to make any annual Tax declarations or keep capital gains records from year to year.

The 10-year rule

If the bond is held for 10 years or more, no additional tax is payable on investment earnings. If the bond is withdrawn before the expiry of the 10 year period, the profit (proceeds less total amount invested) will be included in the investors assessable income and be taxed at their marginal tax rate. However, any profit that is assessable receives a tax offset of 30%.

The tax treatment of investment earnings from the bond depends upon the timing of the withdrawal as follows:

- Up to the 8thyear all earnings are assessable

- During the 9thyear2/3rd earnings are assessable

- During the 10thyear 1/3rd earnings are assessable

- After 10thyear all earnings are not assessable (tax paid)

The 125% Rule

Each policy year, an investor can make contributions of up to 125% of the previous year’s investment. The benefit of this is that the additional contributions do not have to be invested for the full 10 years to acquire the tax paid status. The example below illustrates the opportunity available.

|

Period |

Amount contributed |

Period |

Amount contributed |

|

Year 1 |

$5,000 |

Year 6 |

$15,257 |

|

Year 2 |

$6,250 |

Year 7 |

$19,071 |

|

Year 3 |

$7,812 |

Year 8 |

$23,838 |

|

Year 4 |

$9,765 |

Year 9 |

$29,797 |

|

Year 5 |

$12,206 |

Year 10 |

$37,246 |

(Based on additional investments of 125% of the previous policy year’s investment).

The 125% opportunity can be used past the 10-year mark. As the rule refers to 125% of the previous year’s investment, if no investment is made in any year, any investment cannot be made in the subsequent year without re-starting the 10 year tax free period on the whole balance.

Other tax considerations

Any death benefit paid will be tax free in the hands of the recipient.

Changing investment options within a bond does not usually change the tax status of the bond and therefore generally has no tax consequence for the investor.

Bonds are a tax paid investment and therefore do not generate any assessable income for an investor (unless redeemed before 10 years). They are not suitable investments for gearing purposes (ie. borrowing to invest). As bond earnings are taxed at a maximum of 30%, a bond can be an attractive investment for those on higher marginal tax rates.

If an investor withdraws a bond within the first 10 years, and their marginal tax rates is below 30%, any excess tax offset, can be used to reduce tax payable on other income.

Risks

Taxations and legislative risk

Our information is based on legislative practices of the Australian taxation office and other relevant government bodies as they presently exist. As with most financial related matters there is always legislative risk that provisions may be amended.

Investment risk

The value of an investment bond may fluctuate over time as a result of changes in the value of the underlying investment held.

Investors should be aware that the original capital is not guaranteed (unless the investment option selected offers a capital guarantee) and the value of the investment will rise and fall with prevailing market conditions. Investment values and returns are dependent upon the circumstances of individual investments included in the diversified portfolio, changes in interest rates and exchange rates, and the economic and investment cycles of different countries.

Summary

By investing in a bond, an investor has the potential benefit (depending upon the choices within the particular product) of being able to diversify their investment across all asset sectors and the ability to switch between investment options. A bond investment provides the investors with tax simplicity as the investor does not have to make any annual tax declarations or keep capital gains records from year to year unless a withdrawal is made within ten years. Bonds may also provide tax benefits to investors on marginal tax rates in excess of 19% as there is no capital gain tax or income tax payable on withdrawals after year 10.

What are managed funds?

Managed funds can allow people with a small amount to invest to pool money with other investors and collectively invest a greater amount. By combining resources, you generally have more investment muscle and lower costs. And you may achieve better returns than you could on your own. Plus, the greater spread over different investments means you’re less exposed to movements in individual securities, because all your money isn’t tied up in just a few investments.

Can you access your money?

While investments in a managed fund are pooled, you still have complete control over your own money. Your investment buys units in the fund, and those units are yours to sell, transfer or add to, as you wish (subject to any restrictions relating to the managed fund). Generally speaking your money isn’t locked away.

Even though managed funds are generally medium or long-term investments, you can usually access your money within a few days. Depending on the fund’s cost structure a withdrawal fee may apply for early access. It may also mean that you realise a capital gain, resulting in capital gains tax.

Investment returns

The return you receive from a managed fund generally comes in two forms.

First, there are income distributions these are likely to be paid monthly, quarterly or half-yearly, depending on the fund. You can have these paid in to an account that you nominate or if you don’t need the income immediately, you can reinvest it to buy more units in the fund.

The second component of your return is capital growth. If the value of the fund’s investment rises, then the value of your units goes up and you can take some profits should you choose to sell them at that time. The income-growth composition of your managed fund will be largely determined by the underlying investments or asset allocations you choose.

What are the advantages of managed funds?

There are many benefits associated with investing in managed funds, rather than trying to invest directly on your own. Here are five of the most important.

- Full time professional management

Investment markets move quickly and keeping on top of things requires a lot of attention. Most of us don’t have the time or tools to look after our investment to this degree. Professional investment managers spend their entire working lives thinking and learning about markets, companies, currencies and interest rates. They have access to the latest developments and can act on them instantly. And because they’re professionals, they don’t become impatient, act impulsively, or let their heart rule their head. Their job is to make money for you.

- Spread of investments reduces risk

Even if you did have time to look after your own investments, you generally wouldn’t have the resources to build a portfolio to compare with a major funds manager. This spread of investment is the single most important way to reduce risk. You’re not putting all your eggs in one basket.

- Opportunities beyond your reach

Because of size, managed funds may have access to better investment opportunities. These opportunities may be beyond the reach of individuals, and you may most likely never hear about them. The most effective way to take advantage of these opportunities is through a managed fund that has access to ‘on the ground’ investment professionals.

- Convenience and value

Compared with property, shares or even a term deposit, managed funds are ‘low maintenance’ investments. There are no repair bills, no overdue rent to chase up, no new tenants to find, no maturity dates and no searching for the best interest rates. it’s all done for you. And you may be able to add to your managed fund investment in small amounts, or withdraw small amounts if you need to, possibly within a matter of days. As mentioned above, however, a withdrawal fee may apply for early access and potentially capital gains may be realised, resulting in capital gains tax being payable.

- Tax advantages

Some investment assets offer attractive tax benefits. Australian company dividends, for example, often carry imputation credits that may reduce your tax bill or earn you a tax refund. Managed funds take full advantage of these tax benefits and pass them on to you when they pay income distributions. They also take advantage of the tax breaks on long term capital gains, where only half the profit is taxable (if certain conditions are met), so you may benefit from those tax concessions as well.

Where do managed funds invest?

Managed funds invest in different assets, depending on their objectives. The most important assets to know about are Australian shares, international shares, property, fixed interest and cash.

Let’s start with shares, which are simply investments in real companies either in Australia or overseas. Shares have historically produced higher returns over the long term (at least 5 to 7 years). Over the shorter term (say up to 3 years), returns are less predictable and in some years can be negative (which incidentally, may be a good time to top them up at a lower price).

You can see the real value of shares from this chart. It shows how resilient share markets have been regardless of wars, natural disasters and economic crises. In the short term the ride may have been a little bumpy, but this is put in to perspective when you look back over the medium to long term and see just how far the value of shares has grown.

At the other end of the spectrum is cash. Cash, which in this sense means bank bills and deposits, is seen as the ultimate low risk investment. Returns are predictable but they’re also lower compared with what can be achieved with shares over the longer term. So low, in fact that an investment in cash is unlikely to keep pace with inflation after tax, let alone increase the spending power of your money.

In between cash and shares are the other main asset sectors, namely fixed interest and property.

Fixed interest – mainly government bonds and the like – generally produces better returns than cash but with more fluctuations. It’s possible (but uncommon) for fixed interest to produce a negative return over a year.

Property – such as office buildings, shopping centres and industrial estates are growth investments not unlike shares. Just as shares have a capital growth and dividend component, good property has growth potential and also income through agreed rental yields. Property can go through periods of negative returns but over the long term it tends to produce better returns than fixed interest, though lower than shares.

The relative risk and returns of these different types of asset are illustrated in the panel below. You can choose you own investment mix.

Some funds just focus on a single type of asset. These are useful if you want to build up your investments in that area, perhaps because you already have enough invested in the others. Other funds include a broader mix of investment, usually diversifying across all the main asset sectors.

These include:

- Income funds, that aim to deliver a relatively high and stable level of income, and may include the potential for a small amount of capital growth.

- Growth funds, that pay relatively low income and focus mainly on growing the value of your investment and,

- Balanced funds, that put roughly equal emphasis on income and capital growth.

These multi-sector funds save you having to decide what assets sectors to invest in, so you only have to think about your time horizon and the balance you want between income and growth.

Risk & Return

Matching the fund to your time horizon

When you’re looking at any investment it’s important to keep in mind your time horizon – in other words how far ahead you’re planning for and how long you expect to keep the investment.

Managed funds are best thought of as medium to long term investments, so the minimum time frames for different types of fund are:

|

Type of fund |

Plan to invest for at least |

|

Income funds (including specialist fixed interest) and cash funds |

Up to 3 years |

|

Balanced funds |

5 years |

|

Growth funds |

5 – 7 years |

|

Specialist share funds (including Australian, international and property securities) |

5 – 7 years |

These are useful guidelines but remember that all investment – and growth investments in particular – will reward you best if you’re patient.

Investing Internationally

Investing today is truly a global activity. The internationalisation of investments has forged a global marketplace where the economies of the world increasingly interact with and influence each other. The table above shows the potential benefits that diversification into overseas markets can produce.

The emergence of a global economy has made international investment accessible to small and large investors and given investors the ability to further diversify their portfolio. A properly diversified portfolio now includes different countries as well as different asset classes.

Diversifying over a number of different international markets (like diversifying over different assets such as shares, bonds, cash and property) can reduce investment risk. By investing solely in one market you not only risk poor performance if that market experiences a slow or no-growth stage, you also miss out on the potentially high returns from other established and emerging economies.

There are many reasons why investors should consider investing part of their money overseas.

Such reasons include:

- It enables a spread of risk by being in a mix of markets and currencies.

- Markets and currencies generally all move at different times and while investing overseas investors will be affected by these movements.

- In terms of international sharemarkets, the Australian sharemarket is only a small proportion, less than 2% of the total world sharemarket value. Historically the Australian sharemarket has been more volatile than many of the large sharemarkets in other parts of the world.

- International investment allows investment in expanding sectors of industry that are not represented in Australia through shares on overseas sharemarkets. In the same way it enables access to broader property markets and interest rate markets.

- It enables participation in economies that may be developing and growing faster than ours.

Investing Internationally

Investing today is truly a global activity. The internationalisation of investments has forged a global marketplace where the economies of the world increasingly interact with and influence each other. The table above shows the potential benefits that diversification into overseas markets can produce.

The emergence of a global economy has made international investment accessible to small and large investors and given investors the ability to further diversify their portfolio. A properly diversified portfolio now includes different countries as well as different asset classes.

Diversifying over a number of different international markets (like diversifying over different assets such as shares, bonds, cash and property) can reduce investment risk. By investing solely in one market you not only risk poor performance if that market experiences a slow or no-growth stage, you also miss out on the potentially high returns from other established and emerging economies.

There are many reasons why investors should consider investing part of their money overseas.

Such reasons include:

- It enables a spread of risk by being in a mix of markets and currencies.

- Markets and currencies generally all move at different times and while investing overseas investors will be affected by these movements.

- In terms of international sharemarkets, the Australian sharemarket is only a small proportion, less than 2% of the total world sharemarket value. Historically the Australian sharemarket has been more volatile than many of the large sharemarkets in other parts of the world.

- International investment allows investment in expanding sectors of industry that are not represented in Australia through shares on overseas sharemarkets. In the same way it enables access to broader property markets and interest rate markets.

- It enables participation in economies that may be developing and growing faster than ours.

Managing your own money (IDPS’s)

Most individuals investing for themselves will use an Investor Directed Portfolio Services (IDPS), often without actually knowing they are doing so. These are custodial, transactional and consolidated reporting services, which are often referred to as master funds, master trusts or wrap services.

An IDPS allows you to manage and retain control of your investment portfolio, plus have access to a range of different investments through one service provider, with the advantage of consolidated tax, transaction and performance reporting. Wrap services may also allow you to include other assets in your reports (like direct shares and superannuation) even though you have not purchased

them through the service.

When investments are made via an IDPS, the IDPS consolidates all the information from the providers of the underlying investments and prepares a regular report of the investor.

How does it work?

A wrap service may be set up to include existing investments, to start a new investment portfolio, or to include a combination of existing and new investments. Depending on the product’s deed or governing requirements, the investors existing shares may also be transferred. A master fund or master trust is generally set up for new investments.

When you invest via an IDPS, a personal account will be established for you, which incorporates:

- any existing investments that you wish to transfer to the IDPS (wrap service only);

- new investment options you have selected from the range available within the IDPS, and

- your cash which is retained in the working IDPS cash account.

Generally the cash account handles the flows of money such as:

- distributions of income and capital gains from your managed funds

- dividends from your shares

- proceeds from the sale of investments

- purchases of new investments

- payment of any ongoing fees, and

- any withdrawals you may make.

A percentage of your account as specified by the IDPS provider will always be retained as cash to ensure you can always pay fees as they fall due.

The flexibility of an IDPS varies from one product to another but some of the advantages include:

- access to a variety of fund managers and managed funds

- access to cost efficient wholesale funds which are only available because of the large pooled investment in an IDPS which an individual would not easily be able to access

- ease of switching between asset classes and fund managers when your financial needs and goals change

- consolidated reporting (including taxation) from a diversified portfolio

- generally up-to-date portfolio valuations and asset allocations when required

- a flexible structure that enables you to make regular contributions and also include borrowed money to fund your investment purchases

- additional features such as life insurance may be available.

Generally, you and your adviser can manage all your investments in a consolidated portfolio. An IDPS may therefore be suitable for investors looking for a convenient and effective way to manage a wide range of investments

- Capital stability: Although most mortgage fund values are quoted on a one-dollar-per unit basis, investors should understand that this does not represent a guarantee of capital. Where borrowers are meeting their repayment obligations, there may be little need to revisit property valuations, despite underlying market fluctuations. However, if borrowers are in default – or wish to renegotiate for a further term – the property value again becomes highly visible. Significant defaults within a mortgage fund would have the potential to negatively impact the fund’s capital values, which may then result in a fall in the unit price.

- No capital growth: The return from a mortgage fund is primarily in the form of interest repayments from the borrowers, less manager and administration costs. Capital appreciation on the underlying investments accrues to the benefit of the borrowers, not investors in the mortgage fund, who would simply be entitled to return of capital plus costs in the event of a forced sale (the ‘profit’ belonging to the borrower). Conversely, investors in the mortgage fund bear the risk of capital loss if the property fails to realise its security value – see valuations above.

- Risk of interest rate lag: When general cash rates rise, investors in mortgage funds should understand that such increases may take some time to be reflected in their income distributions. This may occur where the fund holds fixed rate mortgages, or because of a legal liability on the part of the mortgage manager to give appropriate notice to borrowers of the intended interest rate increase.

- Increasing mortgage fund inflows: Mortgage funds have experienced significant net fund inflows, due in large part to short-term turbulence in equity markets. A rapid and significant increase in investment flows could have the following potential effects:

– dilution of returns – the more cash held within a fund, the lower the expected return to investors (due to the differential between cash deposit and lending interest rates);

– deterioration in mortgage quality (due to a lowering of lensing standards in order to place funds; or

– pressure on mortgage managers to alter investment style or asset selection in order to invest excess cash holdings.

Volatility and diversification

The table below shows the level of variability in returns (volatility) that was recorded by the main asset classes over the past ten years. The results that would have been achieved by a “balanced” portfolio are also shown for comparative purposes.

The balanced portfolio used in this example adopts the following asset allocation:

|

Calendar year returns |

|||||

|

Asset class |

Highest |

Lowest |

Average Years |

Number Of negative |

|

|

Cash |

5.65% |

0.42% |

3.83% |

Nil |

|

|

Australian Fixed Interest |

7.97% |

1.28% |

4.75% |

Nil |

|

|

Listed Property |

16.05% |

-18.53% |

0.25% |

6 |

|

|

Australian Shares |

15.71% |

-2.90% |

5.23% |

2 |

|

|

International Shares |

5.71% |

-7.46% |

0.45% |

6 |

|

|

Balanced |

10.24% |

-2.51% |

3.50% |

2 |

|

Source: van Eyk Research Indices used are Australian 90 Bank Bill Index (cash), Australian Commonwealth All Series All Maturities Index (Australian Fixed Interest), S&P/ASX300 Property Trusts Accumulation Index (property), S&P/ASX200 Accumulation Index (Australian Equities) and MSCI World ex Australia (AUD) Accumulation Index (international shares). Balanced portfolio is comprised 5% cash, 25% fixed interest, 10% property, 35% Australian shares, 25% international shares. Past performance is not a reliable guide to future performance.

It can be seen from this table that diversification has the effect of smoothing returns. That is, while a balanced portfolio offers some of the growth benefits of sectors such as property and shares, its cash and fixed interest components ensures that it does not have the same degree of volatility.

Must Reads

Explore more with our handy tools and tips

Superannuation

Let’s Talk Understanding Superannuation Superannuation is an investment vehicle designed to assist Australians save for retirement. The federal government encourages saving through superannuation by providing

Read More »Pensions

Let’s Talk Understanding Account-Based Pensions An account based Pension is a Flexible Tax- effective Retirement Income stream that represents the Income phase of superannuation. Account-based

Read More »About RSA

At Retirement Services Australia, we give our customers all the tools and guidance they need to create an effective retirement planning solution, and we help you every step of the way. We employ retirement planning specialists who offer to help create financial strategies that will suit you for life. We work with you to solve the matters we have touched on in this article. Our traditional clients are delegators who want to know what, why and when things need to happen but prefer to engage experts to do this work on their behalf.